Let’s be honest. For years, the standard employee benefits package has been a bit… one-size-fits-none. You know the drill: a health plan, some dental, maybe a 401(k) match if you’re lucky. It’s a checklist, not a conversation. But the workforce has changed. And honestly, employee expectations have changed even more.

The future of employee benefits isn’t about adding more stuff to the same old box. It’s about tearing up the checklist and building something flexible, human-centric, and genuinely supportive. It’s shifting from a transactional “here’s what we offer” to a relational “here’s how we support your whole life.” And three powerful trends are leading the charge: hyper-personalization, a true focus on financial wellness, and the surprisingly versatile lifestyle spending account (LSA).

Beyond the Checkbox: The Rise of Personalized Benefits

Think about how you stream music or shop online. Everything is tailored to you. So why, at work, are we handed the same benefits as our 22-year-old intern and our colleague nearing retirement? It makes no sense. Personalization is the antidote.

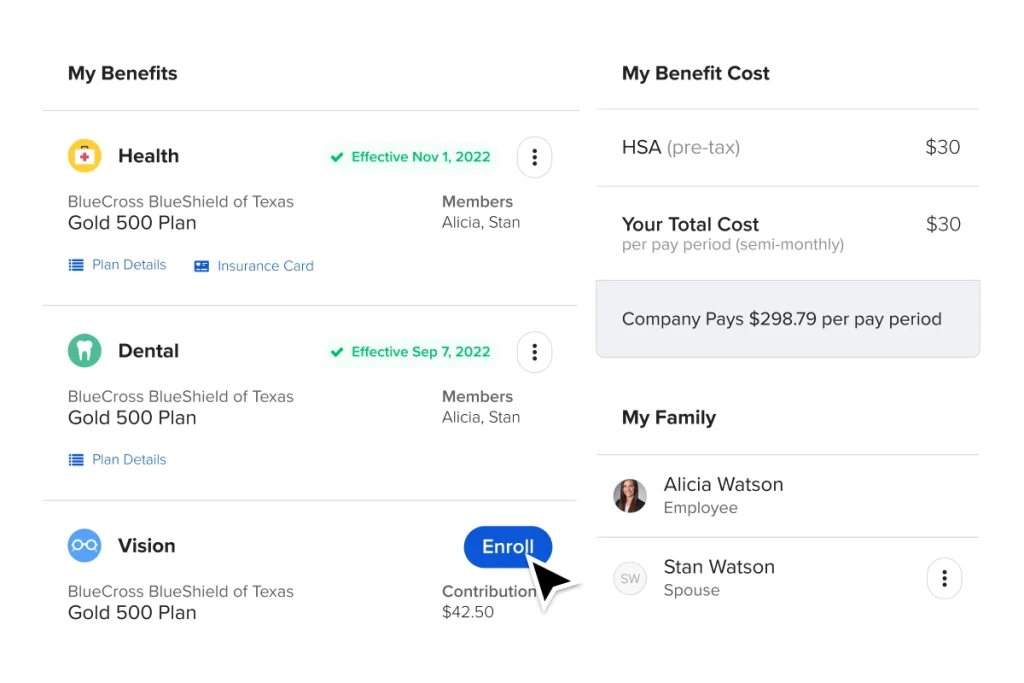

This means using technology—often simple platforms or apps—to let employees choose how to use their benefits dollars. A new parent might allocate funds toward dependent care or a house cleaner. A fitness enthusiast might put it toward a gym membership or a Peloton subscription. Someone else might need mental health support or student loan assistance.

The key here is choice and control. It’s the difference between being given a company-branded jacket (that might not fit) and being given a stipend to buy a coat you’ll actually love and wear. The latter simply feels more respectful. It acknowledges that employees are individuals with unique lives, stressors, and goals. And that’s a powerful message to send.

Financial Wellness: The Benefit That Quiets the Noise

Here’s a universal truth: money stress is loud. It doesn’t stay neatly in a “personal life” box. It follows people into meetings, distracts them at their desks, and burns them out. A 401(k) for a far-off future is great, but what about the financial pressures of today?

That’s where modern financial wellness benefits come in. We’re talking about moving beyond the annual retirement seminar. This is holistic support that feels immediate and actionable:

- Student Loan Repayment Assistance: A direct attack on a massive, anxiety-inducing debt for millions.

- Emergency Savings Accounts (ESAs): Helping employees build a small buffer—often through automated, post-tax contributions—so a flat tire doesn’t become a financial crisis.

- Real-Time Financial Coaching: Access to non-commissioned advisors who can help with budgeting, debt management, or just answering money questions without judgment.

- On-Demand Pay: Or earned wage access. It gives people control over their cash flow, reducing the need for predatory payday loans.

Investing in financial wellness isn’t just charitable. It’s strategic. It reduces “presenteeism”—where someone is at work but mentally elsewhere—and builds immense loyalty. You’re literally helping quiet the noisy, distracting stress in an employee’s mind so they can focus.

The Swiss Army Knife: Lifestyle Spending Accounts (LSAs)

If personalization and financial wellness are the concepts, the Lifestyle Spending Account might be the most practical tool to make them real. An LSA is a flexible, taxable stipend that employees can use for a wide array of expenses defined by the company.

Think of it as the ultimate flexibility tool. Companies set the categories, which can be incredibly broad:

| Wellness & Fitness | Gym memberships, meditation apps, fitness trackers, nutrition coaching |

| Learning & Development | Course fees, conference tickets, books, subscriptions (like MasterClass) |

| Family & Home | Childcare, pet care, house cleaning, meal kit services |

| Community & Lifestyle | Volunteering expenses, hobby classes, travel, even sports equipment |

The beauty of an LSA is in its simplicity for the employer and its perceived value for the employee. For the company, it’s often easier to administer than a slew of separate, rigid programs. For the employee, it’s a pot of money they can actually use on things that make their daily life better, right now.

It’s a tangible signal that the company cares about your life outside of work. That, in fact, supporting your outside life is part of supporting your work life.

How These Trends Work Together: A Real-World Blend

These three ideas don’t exist in silos. They weave together to create a robust benefits ecosystem. Imagine a new hire, Maria. During onboarding, she uses a personalized benefits platform to allocate her resources:

- She chooses a high-deductible health plan paired with an HSA (a financial wellness and choice play).

- She opts into the student loan repayment contribution (tackling her biggest financial stressor).

- She uses her $1,000 annual LSA to pay for a coding bootcamp course (professional development) and a monthly yoga membership (wellness).

Her package is uniquely hers. It supports her financial health, her career growth, and her personal well-being. That’s the integrated future.

The Road Ahead: Challenges and Considerations

Sure, this shift isn’t without its bumps. Communication is huge—if employees don’t understand how to use these flexible benefits, they’re worthless. There’s also an administrative lift in curating the right partners and platforms. And you have to be mindful of fairness and regulatory compliance, especially with taxable stipends like LSAs.

But the direction is clear. The war for talent isn’t won by ping-pong tables and free snacks. It’s won by demonstrating a deep, authentic understanding of what employees truly need to thrive—financially, physically, and mentally. It’s about moving from a standardized package to a supportive partnership.

The companies that get this right won’t just be filling jobs. They’ll be building resilient, focused, and fiercely loyal teams. They’ll understand that the future of work is, fundamentally, human.